Peridot

1031 Exchange

Tax Federal on Capital Gains understanding the basics of 1031 Exchange.

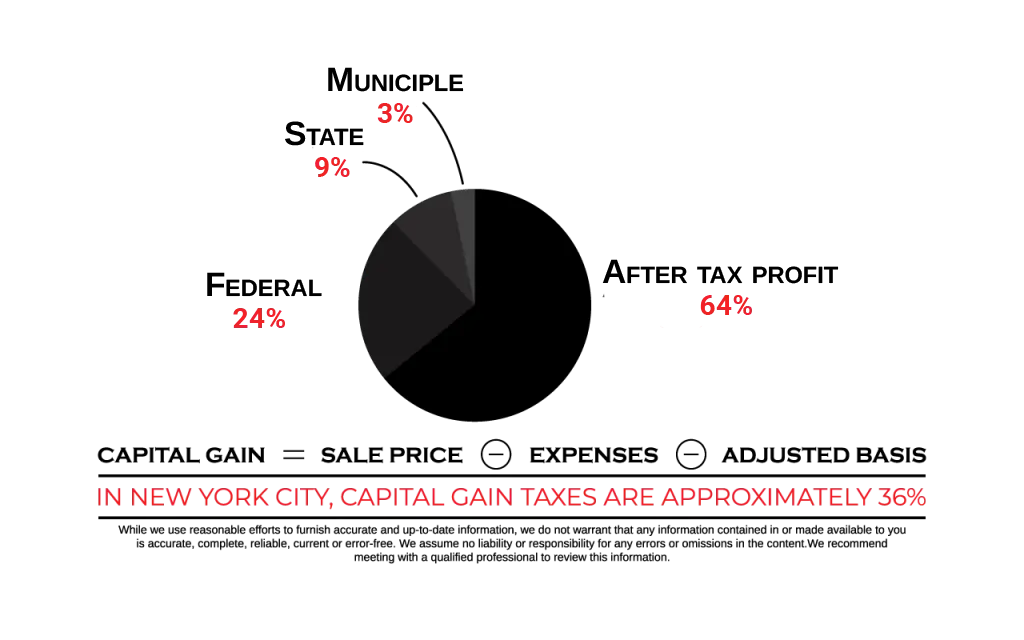

The 1031 Exchange can provide major savings to investors by deferring capital gains taxes. Capital gain tax is a high tax imposed on sellers when the sale price of an asset exceeds the seller’s tax basis in the asset. The original purchase price of an asset becomes that asset’s tax basis and if later the asset holder decides to sell that asset, any amount of the sale price in excess of its tax basis, or ‘gain’, will be taxed at a higher capital gains rate. Fortunately, Section 1031 of the Internal Revenue Code (IRC) offers a special tax advantage which in effect can defer qualifying capital gain taxes.

The 1031 exchange allows for the delay of taxation on the disposal of an investment asset. That is only if the owner utilizes the profits from the sale to purchase another like-kind property or one of a similar nature as defined in the internal revenue code. As an illustration, if you purchased an asset and wish to sell after a short-term hold, for whatever reason, you could be facing a high percentage of short-term capital gains tax on the sale. The 1031 exchange provision allows you to avoid the short-term capital gains by funneling the proceeds of the sale to purchase another like-kind investment property.

Work with Peridot Realty Advisors to see if the sale of your investment property qualifies under the Internal Revenue Code section 1031 exchange program.

1031 Exchange

Below we list some of the things to keep in mind when considering a 1031 exchange for your property.

Investment and Business Property

The 1031 exchange is typically reserved for investment and business properties and cannot be used for the swap of a primary residence. However, some personal property, such as art, may qualify under the provision.

Defining ‘Like-Kind’

The provision allows for swaps of ‘like-kind’ properties, and it is important to understand that this is a broad definition. You can exchange a condo for a commercial space and even exchange raw land for residential or commercial properties.

Qualified Intermediary

The 1031 exchange allows for a swap of properties between two people or entities. However, you will need a third, qualified intermediary, to hold the funds in escrow after the sale of the property and before it is used to purchase the replacement property.

Designating Replacement Properties

The code allows investors and businesses to designate up to three replacement properties if you eventually close on one of the named properties. You may also name more prospective properties if you meet a certain valuation test. You may designate numerous replacement properties as long as the fair market value of the replacement properties does not exceed 200% of the aggregate fair market value of all the exchanged properties.

Closing Time

Keep in mind that you must name your replacement property 45 days after the closing and you will have 135 days to close on that property. You must also close on the new property within 180 days of the sale of the property. These requirements are strict, and it is important to stay organized and not miss a deadline.